🌡️Risk & Safety Scores

Risk and Safety Scores are at the heart of the user experience on One Click Crypto. In the past, DeFi platforms haven’t always been clear about the risks involved. That’s why they’ve been made as easy to understand as checking the weather.

Every asset, protocol, pool, or smart contract on One Click Crypto comes with a clear Safety Score. This score is right there when you look at an option, giving you an immediate sense of its security level. No more guesswork or uncertainty — just straightforward information.

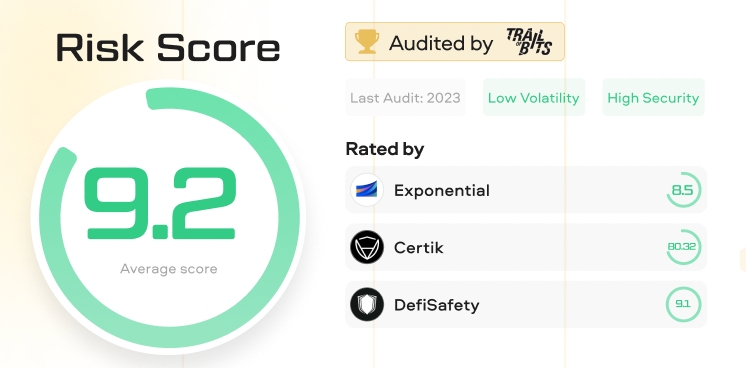

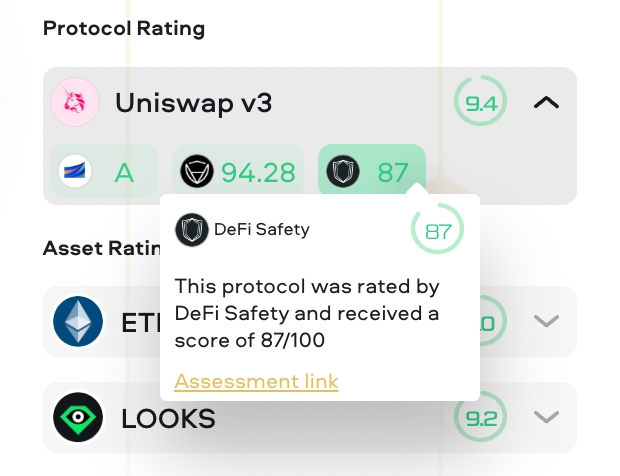

How do we determine these scores? Under the hood, the safety scores are sourced from at least 6 data providers, namely: DefiSafety, CertiK Skynet, De.Fi, Redefine, Spool, and Exponential.

By exploring the elements on the page, you can see a detailed breakdown of ratings by all available providers.

If there are multiple ratings for a single pool/asset/protocol, One Click computes a weighted average score and displays it on the frontend.

This feature aims to provide a much more transparent and secure environment for DeFi users to interact with various protocols, pools, and assets on-chain.

If you’re a risk data provider looking to add your expertise to the mix, we’re open to collaboration. Reach out at [email protected] or join the conversation on our official Discord. Together, we’re making DeFi smarter and safer for everyone.

Last updated