🔻The Current State of DeFi: Problems

In a world full of financial complexities, One Click Labs was born out of a simple vision: to make DeFi products not just accessible but effortless for everyone. We recognized the paradox of choice and the paralysis it can induce. With a plethora of yield farming pools, airdrop programs, and liquidity/staking opportunities, the average user is often overwhelmed, if not entirely deterred. Our mission is to facilitate DeFi adoption by demystifying these complexities, and creating simple easy-to-use web3 products, thereby bringing more users and capital into the web3 universe.

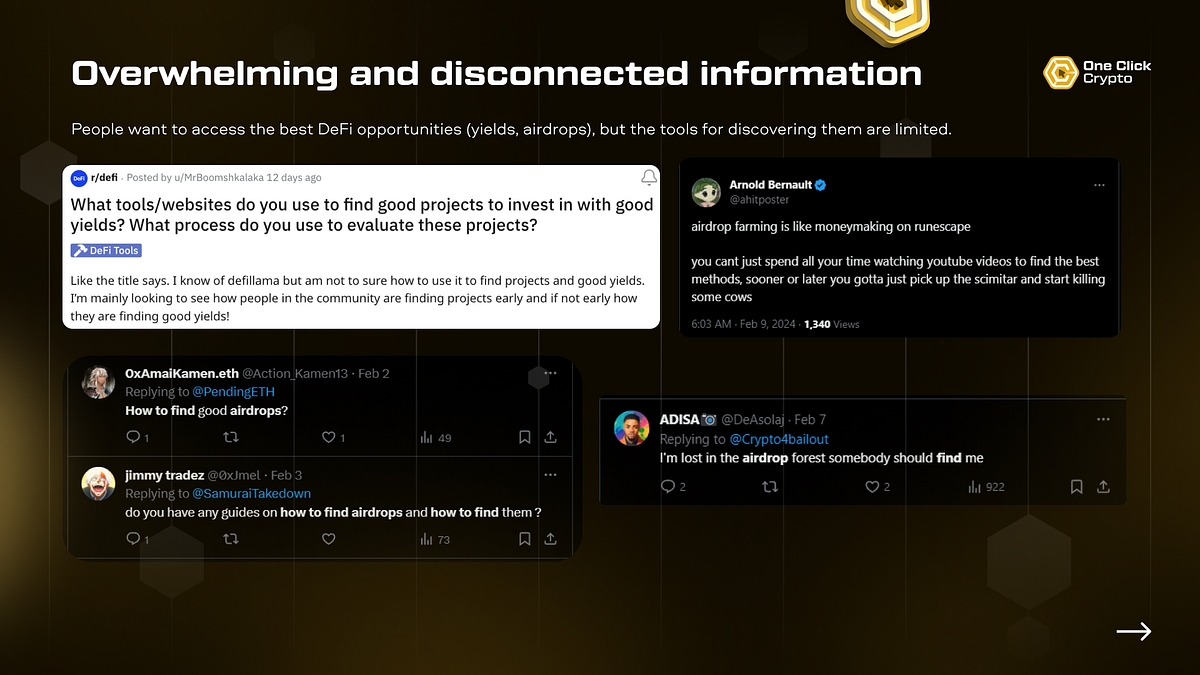

Problem 1: Disconnected & Fragmented Information

DeFi is growing fast, really fast. Every week sees the launch of 22 new DeFi protocols and L1/L2 blockchains on average. Based on Defillama, today we have 246 blockchain networks, over 3,346 DeFi protocols, and more than 10,546 yield-generating pools. But this is just the tip of the iceberg. The current DeFi trackers are only capturing about 1/5 of the total DeFi universe, suggesting there might be so many opportunities located below the radars of online dashboards.

For the average person, who’s not glued to their crypto screens all day, the pace is overwhelming. New opportunities, like airdrops, come and go so fast that if you blink, you might miss out on what’s basically free money. It’s like almost every new blockchain layer is throwing out a welcome bonus, but only those in the know can catch it.

Right now, if you are a DeFi user, you have to juggle between a dozen browser tabs, countless Telegram channels, and hundreds of Twitter feeds just to stay in the loop. It’s a lot, and it’s messy.

The composability of DeFi is both a blessing and a curse. The fact that you can interconnect various DeFi protocols with each other offers a great opportunity to create more comprehensive decentralized financial systems, but this creates an additional layer of complexity for an average joe. The terms like LP, impermanent loss, frontrunning, or vote-escrowed governance, don’t help either.

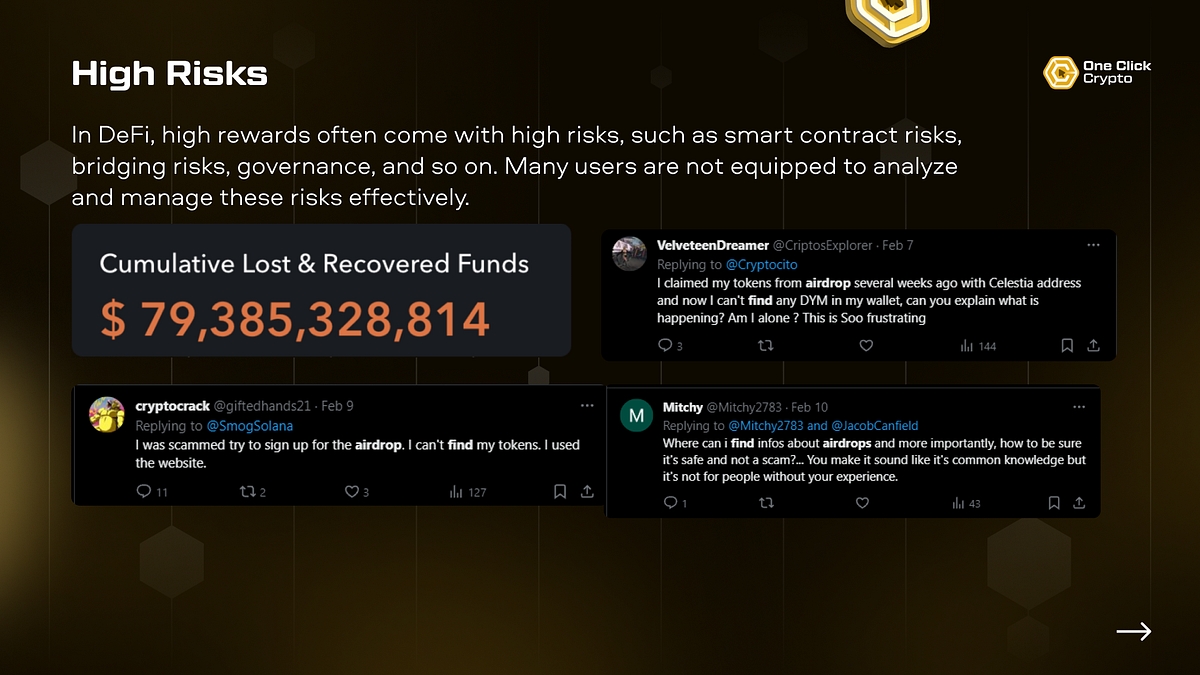

Problem 2: High Risks & Opaqueness of Risks

Everyone who’s been in crypto long enough lost money. It could have happened due to hacks, exploits, wallet drainers, scams, shitcoins, or just poor investments. More than $79 billion was lost in DeFi. It’s almost accepted as ‘normal’ in DeFi. But it doesn’t have to be this way.

A big part of the problem is that most DeFi projects don’t talk much about risk. They’re quick to tell you about the profits you could make but tend to skip over what could go wrong. And that’s a big missing piece. When you’re putting your money into something, you should have a clear picture of what the risks are.

Users often ask, “What’s the best DeFi opportunity right now?” and “Can I trust this project?” They want to know the risks and what they might earn back as a return. But finding clear answers to these questions isn’t easy. There’s a need for transparency about the risks in DeFi, and so far, it’s not being met.

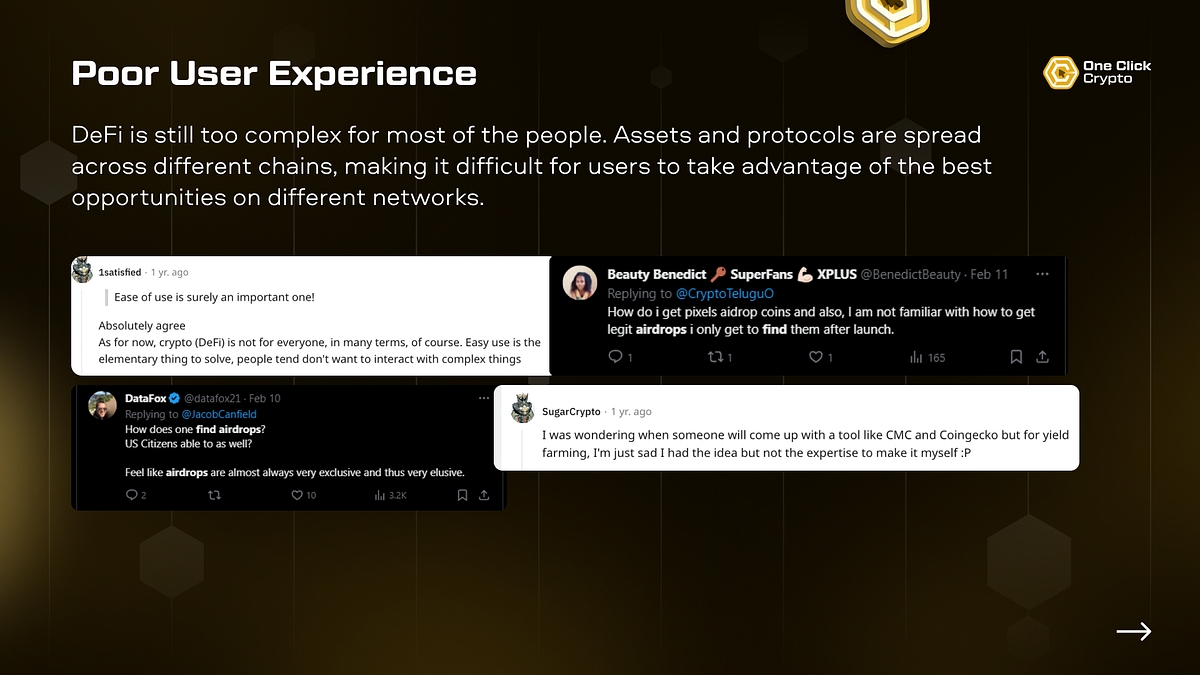

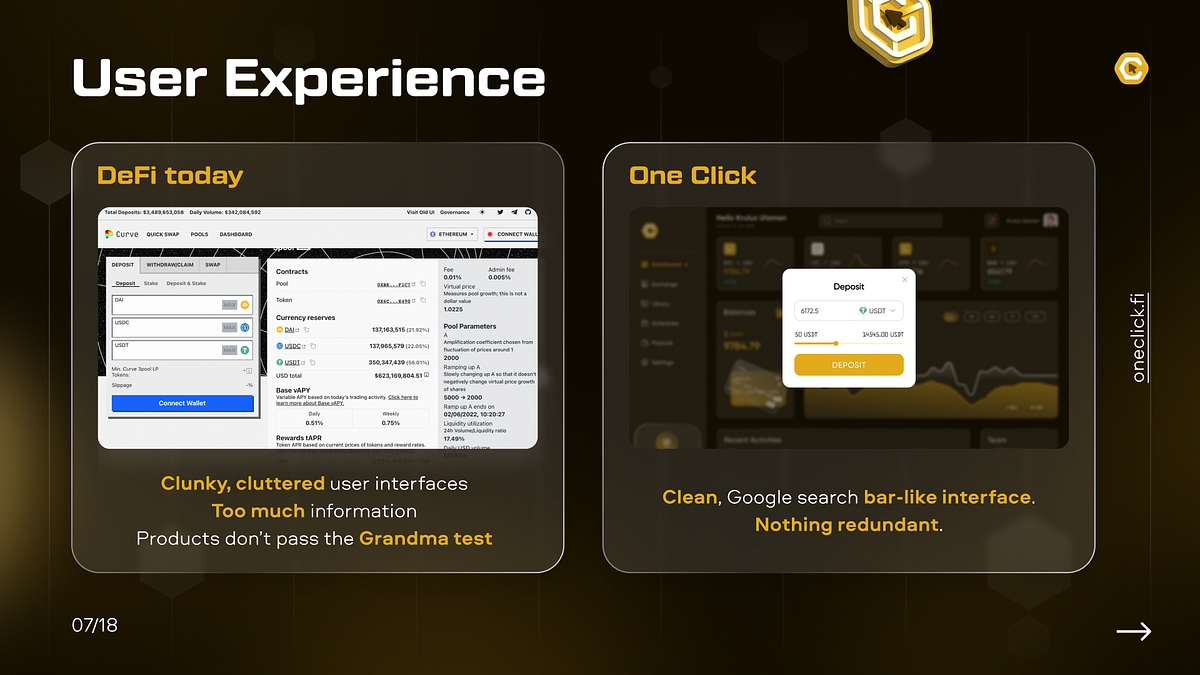

Problem 3: Clunky UX

The Challenge of Overwhelming Interfaces

DeFi today is like walking into a room where everyone is talking at once. You’ve got information on yields, liquidity pools, and token swaps coming at you from all sides. It’s a lot. For instance, a DeFi platform might show you 10 different numbers and percentages for a simple deposit, but which one do you need to care about? This information overload isn’t just confusing — it’s a roadblock for people who are new to DeFi.

The Necessity for Intuitive Design

When it comes to design, less is often more. The best tools out there are ones that don’t make you think too hard, like Google’s search bar. It’s a model of simplicity. That’s what we need in DeFi: a clean, straightforward design that anyone can understand at a glance. No one should need a manual to figure out where to click to make a deposit or check their balance. An intuitive interface isn’t just nice to have; it’s crucial for bringing DeFi to a wider audience.

The Grandma Test

Think about your grandma using DeFi. Could she make a trade or lend her tokens without calling you for help? That’s the “Grandma Test,” and right now, most DeFi platforms would fail it miserably. The best test of a product’s user experience is whether it can be used by someone with no prior knowledge of the subject. If we want DeFi to be as big as the internet one day, it has to pass the Grandma Test.

Problem 4: Cross-chain Friction

Imagine you’re shopping online, but each item on your list is sold in a different store, and every store is in a different city. That’s what dealing with multiple blockchain networks can feel like. You might find a great yield opportunity on Ethereum, but the next day, there’s a better one on Arbitrum. Keeping up isn’t just tough; it’s a full-time job. For example, to move your assets from one chain to another often means navigating through a maze of wallet addresses, bridge services, and sometimes even different currencies.

Moreover, each chain has its own set of rules and gas fees, which can eat into your profits if you’re not careful. Transferring tokens between chains can get expensive and risky, as the bridge platforms themselves can be points of vulnerability. In July last year, a major cross-chain bridge was hacked, leading to a loss of over $190 million worth of cryptocurrency. This kind of news can discourage even the most enthusiastic DeFi user.

The cross-chain issue isn’t just about convenience; it’s about security and cost-effectiveness too. Without a solution, DeFi’s growth could stall, with users sticking to what they know rather than seeking the best opportunities.

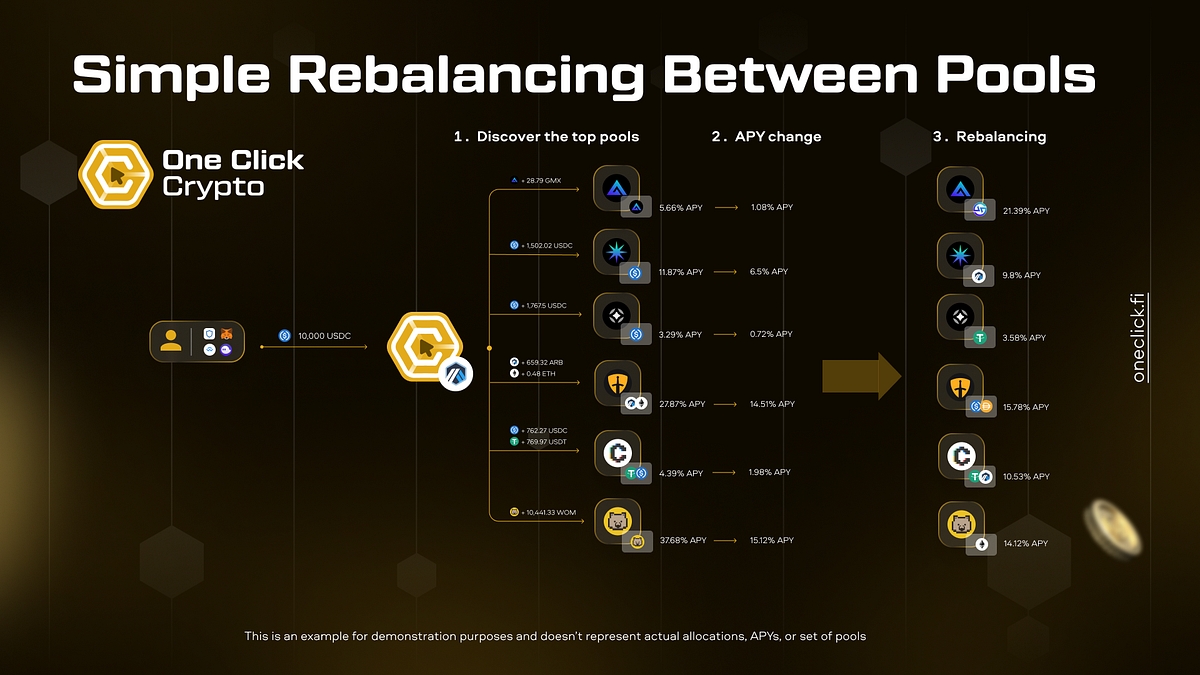

Problem 5: Variable Yields

DeFi yields are about as stable as the weather in the mountains — bright and sunny one moment, a downpour the next. You might put your crypto into a pool that’s offering a great annual percentage yield (APY) of 30%, but just a week later, it could plummet to 10%. It’s unpredictable. To stay on top of this, you need to be constantly on the lookout, ready to move your assets to where the yields are best.

It’s like having a job where you’re on call 24/7. You need systems to alert you the moment yields change, and then you have to act fast to rebalance your portfolio. And that’s not even touching on impermanent loss.

Managing a DeFi portfolio is like juggling — you’ve got to keep your eyes on all the balls at all times, or else you’ll drop them. It’s intense, and for many, it’s too much. Without the right tools to manage these changes automatically, most people are just watching from the sidelines.

Last updated